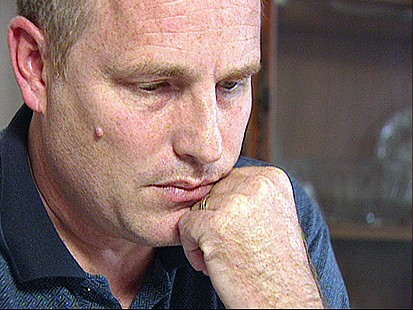

“I started getting tremors, shaking real bad in my hands and feet, making typing difficult or impossible at times, and writing getting worse under stressful conditions,” Tucker said. “I started having numbness in the hands and feet, severe, severe headaches.”

Tucker, who supports his wife, two daughters and baby grandson, was so tired he was falling asleep at work.

Soon, Tucker realized his fatigue and trembling were actually part of something much worse.”He is suffering from multiple sclerosis, which has basically disabled him from performing his occupation,” said Dr. Daniel Nieves Quinones, Tucker’s neurologist.

Too sick to keep working, Tucker reluctantly left his accounting job.

“It was a very emotional, very difficult thing to do, to leave my job and wonder, you know, how I was going to support my family,” he said.

Luckily, Tucker had been paying for long-term disability insurance with the Standard Insurance Company.

Last June, Tucker filed a claim with Standard. He did not receive a denial, but for months he could not get an answer. All he got were notices that the company needed more time and requests for more information.

Tucker was worried, so he hired an attorney and they obtained his records from Standard. Inside his file he discoved a surprising medical report from a doctor who works for Standard. That doctor had never met Tucker.

It was the expert opinion of 11 doctors that Tucker had MS, but the insurance company doctor said there wasn’t enough evidence. In an official report, he said, “the diagnois of multiple sclerosis is not supported … and the patient could return to a sedentary work activity.”

Tucker said the report was devastating.

“I mean, it took me almost two years to really accept the fact that I did have this disease,” Tucker said. “I had all these doctors telling me I did. And then this guy, who’s never seen me — from my understanding, he doesn’t even see patients; he does reviews like this on a routine basis — would say something like that.”

Critics Call Insurance Doctors ‘Hired Guns’

Quinones said the insurance company doctor never even contacted him about Tucker.

“My honest opinion is that you can’t arrive to the conclusions that he arrived at after reading his report withought having a proper evaluation of your patient,” Quinones said.

And Standard Insurance Company isn’t alone. Most insurance companies hire their own doctors to review patients’ claims without any in-person examination.

John Morrison, who just stepped down from his job as Montana’s insurance commissioner, said doctors who work for insurance companies risk being in their pocket.

“There’s no question that in certain cases, disability income carriers and health carriers use hired gun physician opinions in order to deny claims,” Morrison told ABC News.

What’s worse, Morrison said, is that in 39 states, insurers can add legal language to their policies, called “discretionary clauses,” which enable them to uphold claim denials in court based on evidence, such as reports from their in-house doctors.

“If there’s a little bit of evidence that supports denying the claim, such as the opinion of an in-house doctor, then a discretionary clause may support and uphold the denial of the claim by the insurance company,” Morrison said.

‘GMA’ Gets Answers

Tucker contacted “Good Morning America” to help get answers.

“GMA” asked Susan Pisano, spokeswoman for the insurance lobbying group America’s Health Insurance Plans, about the critics who say some doctors that work for insurance companies are hired guns.

“Ten billion dollars are paid out in claims. Five-hundred-thousand people are receiving disability claims annually,” Pisano said. “You know, I know a lot of physicians who are employed by disability carriers. The typical profile is a very smart, very compassionate physician who understands the health care system.”

“But you can find out if you don’t have MS or leukemia from somebody who has never seen you?” “GMA” anchor Chris Cuomo asked Pisano.

“Well, my understanding of the way this works is that the reviewer is looking at whether the medical record supports these claims,” Pisano said.

Health Insurance Denial

Standard would not talk on camera, but did issue a statement saying that Tucker’s claim was handled in a “thorough, responsive, ethical and fair manner.”Tucker had waited for Standard to approve his claim for five months, and says he was in a hellish limbo during that time. But just a day after “GMA” called Standard, they said they were now approving Tucker’s claim. The company said an independent medical review now confirmed Tucker does have multiple sclerosis after all.

Tucker is less nervous these days. Standard now pays his disability benefits, which are about 40 percent of his old salary and which allow him to support his family.

Standard said it paid Tucker when he became eligible and deny that “GMA” was the reason they paid him. But Tucker and his lawyer are grateful to “GMA” for helping and for shining light on his problem.

“It’s just absolutely terrible, and I don’t think people ought to have to go through this,” Tucker said. “I’m very hopeful that by doing stories like this that you are doing, that you can bring this to light.”

_________________________________________________________________________________________________________

Cody Allison & Associates, PLLC fights on behalf of individuals to obtain their long-term disability benefits. If you believe you have been wrongfully denied your ERISA, or non-ERISA, long-term disability benefits, give us a call for a free lawyer consultation. You can reach Cody Allison & Associates, PLLC at (615) 234-6000. We are based in Nashville, Tennessee; however, we represent clients in many states (Tennessee, Kentucky, Georgia, Alabama, Texas, Mississippi, Arkansas, North Carolina, South Carolina, Florida, Michigan, Ohio, Missouri, Louisiana, Virginia, West Virginia, New York, Indiana, Massachusetts, Washington DC (just to name a few). We will be happy to talk to you no matter where you live. You can also e-mail our office at cody@codyallison.com. Put our experience to work for you. For more information go to www.LTDanswers.com.